Taxation Law Dissertation Help

2500+

Student Reviews

Average Rating 4.7

Assignments Delivered.

1.26k

PhD Experts Onboard.

2.5k+

Active Student Members.

55k+

Universities Covered.

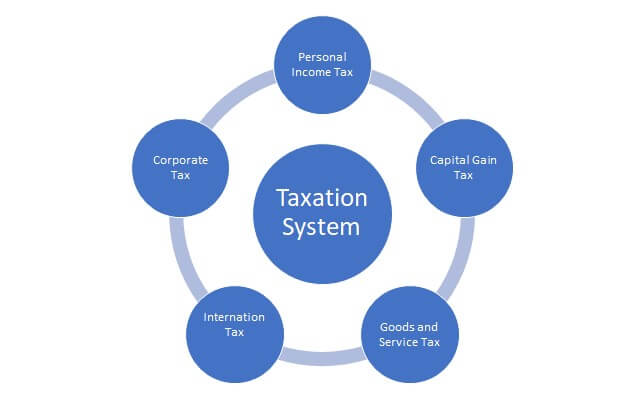

Taxation system is introduced with an aim to fulfil the financial needs of the government for the allocation of budget to the various authorities. Tax law is the set of rules and regulations that regulates the taxation system. Australian tax law is bifurcated into direct tax, indirect tax and International taxation along with different rates and exceptions set for tax collection process. Student from the different law universities across the country pursuing graduation or post-graduation in law, get the dissertation topic on taxation. It is necessary to have in-depth knowledge of the subject before starting. This knowledge can be acquired through our taxation law experts who have experience in preparing dissertations in the same field and have good analytical skill. Students who face insolvable trouble in crafting their Taxation Law Dissertations, seek for external Taxation Law Dissertation help from external because dissertations is a very important document that has to be of good quality.

There are several components of taxation on which our assignment help experts have written dissertations and other academic documents. Following are a few taxation topics on which our Taxation Law Dissertation experts have written several documents, such as:

Authority imposes this tax on personal income of individual on a progressive basis, which means person with higher income have to pay higher tax and under this burden is on the individual to pay the tax to the Federal, State government.

This tax is applied on the disposal of short term or long-term asset by individual except personal home used for staying. Problem face under this is regarding the exception and application of the related laws.

This tax is paid by the company at a flat rate of 30% and small business is paying at 25 %, it is paid to the authority before distribution of dividends to the shareholder.

It consist of Franklin credit system to avoid double taxation and applicable on the concept of dividend only. Concept of transfer pricing and tax heaven are other important topic on which our special Taxation Law Dissertation experts can provide the guidance and help in crafting HD quality dissertation.

Topics discussed above are very technical as exemption is provided on most of the income and students are facing problem to apply these exceptions in the right situation and our experts making it very easy for those students by providing best assistance. These experts apply their best skills to understand the dissertation requirement and applying their knowledge in Making HD quality dissertation. Additionally, we have quality control team who will review the assignments and ensuring that the assignment meets all the criteria as per the instruction given by the student and they also ensure all the grammatical and spelling mistakes are being removed. Use of some of the best plagiarism software such as Turnitin removes the chance of work duplication.

In order to reach us for the best Law assignment help, you can contact via call or drop an email. We promise to deliver best legal expert services at reasonable prices and within stipulated time frame without hampering the quality.

Your Identity is yours. We don’t tell, sell or use your contact info for anything other than sending you information about your assignment services.

Exercise your power to choose academic editors with expansive knowledge in their field of study. We are NOT run of the mill assignment help.

Everything new and nothing to hide. Get edited assignment papers that are devoid of plagiarism and delivered with a copy of the Turnitin Report.

Fear no Deadline with our skilled assignment editors. We even offer super express assignment delivery time of less than 6 hours.

We are always up and awake. Get round the clock expert assignment help through our dedicated support team and live chats with your chosen editors.