Tax Adjustment Assignment Help in Australia

2500+

Student Reviews

Average Rating 4.7

Assignments Delivered.

1.26k

PhD Experts Onboard.

2.5k+

Active Student Members.

55k+

Universities Covered.

Online Assignment Expert has hundreds of PhD writers to offer you with the best Tax Adjustment Assignment Help Australia with 100% originally drafted papers. Our experts are natives of Australia, and that is why you get a tailor-made solution that is unique and of high quality.

Tax Adjustment determines the considered development or reduction in a Tax, decided on an investment-by-investment or activity base. It practices the theories drawn, following from a settlement offered or recommended by a Taxing Authority based on any measure considered or expected to be displayed on any Return linking to such Tax. And resulting in assumptions in the state of Income Tax, the most distinguished marginal Tax flow or, in the state of any additional Tax, or any part of the Taxable limit to which the payment reports.

Tax Adjustment decision shall be performed without respect to any genuine progress or reduction in the before-mentioned Tax concerning the return to such adjustment reports. When the deadlines are approaching, the realization hits the students that they need to submit their paper. Then most cases, they miss the submission date. Then we have to take the Online Assignment Expert help in Tax Adjustment Assignment as our experts complete the papers on an urgent basis and give the other value-added services.

Whether your homework is scheduled for submission the next day or an in a few hours, our subject matter expert can take the weight of the deadline when the Online Assignment Expert is here. Order our team of PhD academics Tax Adjustment Assignment Experts for essential assignment guidance, and we will accept it in an instant.

Our expert adheres to all the university guidelines and your requirements when giving Tax Adjustment Assignment Help in Australia. Tax Adjustment Assignment Expert overcomes the assignment marking rubrics, and you get high marks. Let's now read the case study on which the professors need the student's well-performed answers.

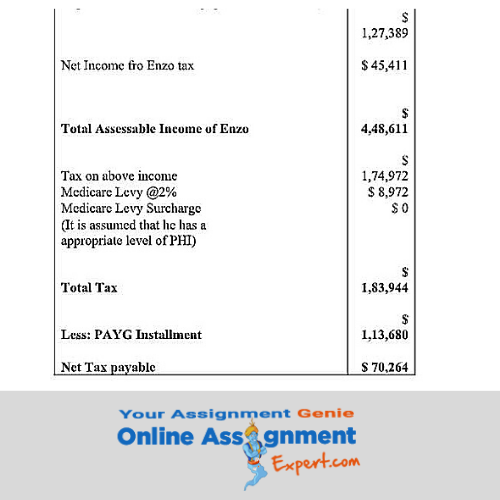

Here the assignment demands the student to use legislation and case law to confirm the answer. The questions present the learner with different aspects and then examine the details according to the relevant to the assessment paper. In case the learners don't have the right knowledge to compose the correct solution, then subject-matter experts at Online Assignment Expert give the Tax Adjustment Assignment help online with high-quality papers. Here is a glimpse of recently drafted solution:

To get hands on the solution that gets the top grades, what you desire, Online Assignment Expert helps you with it. You just need to give us the essential aspects of the assignment in the order form. Fill the complete form with the deadlines, content, or material required and specifications for the Tax Adjustment Assignment Experts to follow. If needed, upload the essential documents for the academic paper.

We have calculated all types of problems that need to be solved and made the necessary adjustments that are asked in the assessment papers. Tax Adjustment Assignment Experts can make the tax adjustments that are only recognized and measured at year-end. But, most of the data needed is possible at the moment it is inserted into the software which our experts use. Tax adjustments could be handled in various forms, and our writers have given the Tax Adjustment Assignment help online to estimate the correct answers:

Our expert uses the software that is devised to assist firms and determine the exact treatment. For especially complex reports, a tax agent might be advised to examine the method adopted by a business to change an approach. We are skilled in guaranteeing that we use the acknowledged way of handling these adjustments for tax objectives. This commonality will gain the assurance and accuracy of the estimates. Some of the standard tax adjustments are:

Depreciation is usually only worked at the conclusion of the year; even if all the data needed to manage it is accessible throughout the year. The skilled expert estimates them at year-end.

We cover the critical debts completely at the year-end with the help of the knowledge and expertise of the experts to help in Tax Adjustment Assignment.

We compute the trading stock adjustments that are worth of perpetual inventory methods. Our expert uses it to estimate the cost of goods traded more frequently.

Recognizing and quantifying lessors is an essential adjustment for accounting returns.

It is also an essential adjustment for accounting income.

Recognizing and quantifying debtors is an essential adjustment for calculating the income.

It is an essential adjustment for accounting profit. It can be involved where improvements and resources require to be divided into money and income investment.

The adjustment is made using the benefits and/or investment returns to adjust the various accounts.

We recognize prepayments that are needed for the adjustment for accounting. Like few are trivial such as subscription and others are more substantial prepayments will need to be implemented for. There is an agreement that if they get within the following time, they don't require to be set for.

At the Online Assignment Expert, you will receive some of the highest quality papers from our experts. We have 100% client satisfaction when they take count on us for accounting assignment help in Australia. We offer our help and other services that are effective samples that also help you in your exams and follow the university guidelines in Australia.

You get the best assignment help that is given to many other students and it has been more than a decade now. You get the best value-added services in Australia, and we write the solution after evaluating the learner's assignment requirements. Online Assignment Expert strives to produce the best feasible solutions written by knowledgeable writers, expert professors, experienced editors, and other 2500+ subject matter writers. Below are some of the perks that you get when you order our Tax Adjustment Assignment Help Online:

Improve your grades by filling the Online Assignment Expert form with all the Tax Adjustment Assignment requirements, and we will contact you soon!

Your Identity is yours. We don’t tell, sell or use your contact info for anything other than sending you information about your assignment services.

Exercise your power to choose academic editors with expansive knowledge in their field of study. We are NOT run of the mill assignment help.

Everything new and nothing to hide. Get edited assignment papers that are devoid of plagiarism and delivered with a copy of the Turnitin Report.

Fear no Deadline with our skilled assignment editors. We even offer super express assignment delivery time of less than 6 hours.

We are always up and awake. Get round the clock expert assignment help through our dedicated support team and live chats with your chosen editors.