March 18, 2020

MPF753 Mergers and Acquisition Case Study Assignment Answer

No 1 Assignment Help

is only a click away.

This assessment is about writing a report based on a case study that should not exceed 2500-words. Almost every organisation has Mergers and Acquisitions to grow. Thus, it is important to understand this term before proceeding to write a report. Our assignment help experts have solved numerous assessments on this topic for students who found them challenging. M&A can be explained as a transaction where the ownership of an organisation, its operating units, or other business organisations are consolidated or transferred with other bodies. However, let us read the details of MPF753 Mergers and Acquisition assessment and what is the correct approach to writing the answer to this assignment.

What Should Be Kept in Mind While Solving the MPF753 Mergers and Acquisition Assignment?

Every assessment assigned to university scholars has its aim and objectives. If we talk about the objectives of MPF753 Mergers and Acquisition assessment, it includes the following:

- Understanding of determining the stock returns and how to analyse the Mergers and Acquisitions (M&A) market of Australia.

- Compare and calculate the percentage stock returns and observing the organisations acquisition performance.

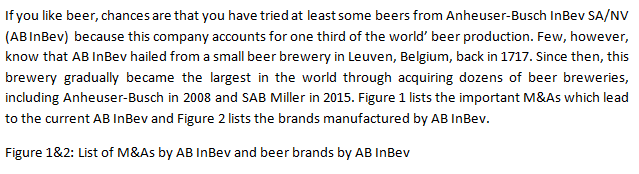

It is well-known that almost every organisation grows with the help of M&As. For example –

Based on the above scenario, you are supposed to act as a financial advisor to a company offering strategic financial services to clients having high net worth where you are required to provide professional advice to clients interested in understanding the value of Mergers and Acquisitions.

Based on the above scenario, you are supposed to act as a financial advisor to a company offering strategic financial services to clients having high net worth where you are required to provide professional advice to clients interested in understanding the value of Mergers and Acquisitions.

How Do M&A Announcements Affect Stock Returns of Both the Acquirer and the Target?

In MPF753: Mergers and Acquisitions assessment, there are two questions to be answered correctly to score better grades. Here, you will come to learn the best approaches to answer them.

To find out the effects of M&A announcements on acquirer and targets, you must identify the two different completed acquisitions that involve one ASX-listed organisation acquiring other ASX-listed organisation. Our case study assignment help experts suggest that each acquisition should include the following:

- Target company’s ticker and Acquirer on ASX;

- The exact date of announcing this acquisition;

- Offer price

Also, discuss the offer premium and what you have learned from those outcomes.

How Do You Calculate the Abnormal Long-Term Stock Returns after the Announcements of the Takeovers?

In order to calculate the abnormal long-term stock returns of a company, it is important to know the acquirer firms' performance that can be analysed from question 1.

You must use the following to determine the three-year holding period return:

Three-year holding period return = [(P3 – Pt)/Pt] * 100

To know more about the MPF753 Mergers and Acquisition case study assignment, you must look for the best case study assignment help service provider in Australia. Online Assignment Expert can be the best choice for you if you want someone to help you in writing a report for the MPF753 assignment. With our experts, you will be assisted in numerous ways such as writing, editing, proofreading, quality check, and plagiarism check. You can also request us for a free MPF753 mergers and acquisition assignment sample. Do visit our website, Online Assignment Expert, to find out more about our academic services and place your order via the form. Our customer care executives will get back to you in the shortest time!

Related Blogs

Subscribe Our Newsletter & get Information about latest courses