July 03, 2021

How Online Experts Solved The Income Tax Payable Case Study?

No 1 Assignment Help

is only a click away.

Income Tax Payable Case Study is quite intricate, and they are not as simple to solve as they appear to be. To implement taxation, students must juggle a large number of formulas. If you need the Accounting Assignment Help, the tax assignments produced and solved by tax specialists would be the best tax assignment paper to consult. Online Assignment Expert can provide students with the greatest options for tax assignment help. Obtaining the greatest tax assignment from pros can be a difficult undertaking. Students must be cautious while selecting tax assignments to help professionals and solutions to rely on.

The Calculation of Taxable Income Explained By Our Experts

On a broad level, income tax payable and deferred income tax liability are comparable in that they are financial liabilities that appear on a company's balance sheet. However, from an accounting standpoint, they are distinct entities because income tax payable is a tax that has yet to be paid.

It's still on the balance sheet because the tax period isn't over yet. For example, if a company's tax liability for the next tax period is $1,500, the balance sheet will show a $1,500 tax payable balance that must be paid by the due date. This can help you in solving Income Tax Payable Case Study.

It is critical for businesses and organisations to understand how to determine Calculation of Taxable Income on the balance sheet in order to provide correct financial reporting.

- Take the totals of all the taxes that must be paid, such as income tax, Medicaid tax, personal income tax, and welfare payments tax. Add up the totals of all the taxes.

- Check the balances to see if they already include the employer's payment, especially on the Social Security and Medicaid accounts.

- To the sales tax liability account, other municipal taxes, and state income tax, add the total.

- Calculate the total amount and enter it in the Tax Payable column of the balance sheet.

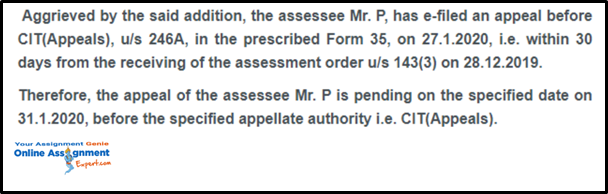

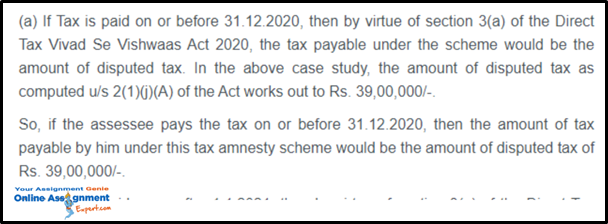

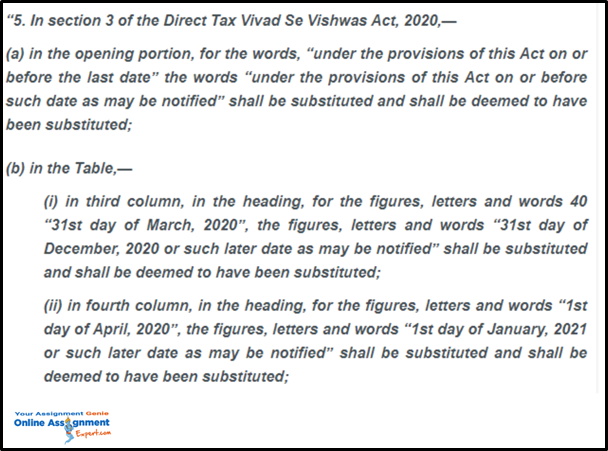

Down here, we have attached the sample of an assignment and solution file that has been solved by our dedicated team of experts. You can take a reference of our work through it:

How Can You Deal With The Income Tax Payable Case Study?

Accounting Assignment Help is provided by highly qualified taxation experts that identify unique passion and exciting ideas to operate in this subject. As a result, taxes is seen as a profession in great demand among students. Various universities also offer a variety of taxes courses. A student who wants to follow a taxation course usually needs a better comprehension of the subject as well as highly rigorous services, including certification options. A variety of assignments are included in the taxes course. Students, on the other hand, frequently struggle to complete tasks properly and efficiently. If you are unaware of the Calculation of Taxable Income, and your assignment deadline is nearer to hit you then you are free to seek assistance from us at any time.

How Does Our Experts Assist You with the Income Tax Payable Case Study

Taxation in general, as well as the different laws that govern it, is difficult to comprehend since it necessitates complex computations and a thorough examination of rules and regulations. Professors assign unique taxation exercises to students in order to assess their understanding of the subject. This enables teachers to assess their pupils' readiness to meet the field's real-world challenges. Our Accounting Assignment Help experts have compiled a list of the most important factors based on their extensive experience and knowledge:

- Knowledge of how these laws are being applied in various situations;

- Calculation skills of students;

- Students' information about the applicability of taxes based on the type of business;

- Students' capacity to consider how rules and regulations have changed.

- Because the tax system's rules and regulations change on a regular basis, it's critical to stay current. This will motivate pupils to complete better assignments and earn higher grades.

It is not, however, as simple as it appears. Our Accounting Assignment Help professionals assist students to the best of their abilities in order to make the academic journey as simple as feasible.

Our Income Tax Payable Case Study Includes The Following Features:

Finding a reliable firm to perform your projects is difficult. However, your search stops at Accounting Assignment Help where a team of expert authors will provide you with the greatest answers for your projects.

We at Online Assignment Expert has a number of unique features, including:

- Professionals with extensive knowledge of the region

- Expert counsel provides a realistic understanding.

- Trained professionals who are up to date on the latest tax rules and regulations

- Thorough understanding of all aspects of the subject Thorough understanding of the legislation of the countries in question

- Total progress and completion rate in resolving the most difficult taxation issues.

- It's very intriguing to follow the examiners' instructions.

- Highly competent at utilising resources and applications to achieve a superior result.

Our panel is meticulously designed, making it one-of-a-kind and plagiarism-free.

Furthermore, our Income Tax Payable Case Study writers welcome your inquiries or comments about the project even after it has been delivered. The main goal is to present you with an answer that is on par with your level of pleasure. As a result, they make the necessary changes based on the needs of the consumer. What will you get from our Accounting Assignment Help?

Client service is available 24 hours a day, 7 days a week to answer any of your questions. Feel free to get in touch with us.

Related Blogs

Subscribe Our Newsletter & get Information about latest courses