February 01, 2020

HI6028: Taxation Theory, Practice & Law Assignment

No 1 Assignment Help

is only a click away.

Today, in this blog, we are going to discuss HI6028: Taxation Theory, Practice & Law Assessment with the help of a taxation law assignment expert. They say that the Unit Code HI6028 is an individual assignment for trimester 1. This assignment generally asks you to answer a few questions which should not be more than 2000 words.

Understand What is Required in the HI6028 Taxation Law Assessment

Once you successfully complete the HI6028 assignment, you can easily assess the following points:

- Develop a better understanding of the Australian income tax system, different aspects of deductions and income, FBT, CGT, GST, income tax administration and general anti-avoidance provisions.

- Find and analyse taxation-related issues.

- Explain case law and taxation legislation.

- Apply taxation principles to real-life issues.

How Does Our Taxation Law Assignment Expert Write the HI6028 Assessment?

Students studying taxation law must have knowledge and skills to conduct research on Australian tax law, developing strategies to minimise tax liability, prepare tax returns, estate planning, resolve tax issues, and so on. Our taxation law assignment experts have explained the right approaches for HI6028 - Taxation Theory, Practice & Law assignment.

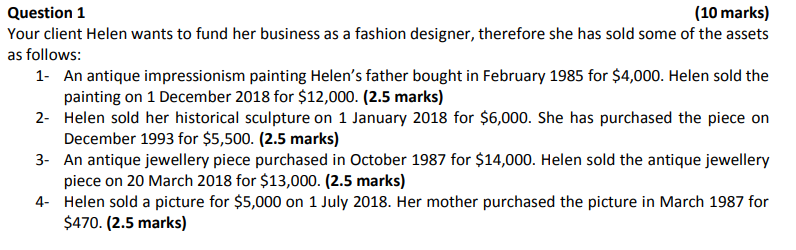

Based on the above scenario, you are required to advise the Capital Gain Tax consequences of the above transactions.

To solve the above question accurately, you must structure your answer in the following way:

Capital Gain Tax in terms of antique impressionism painting

- Recommend the Capital Gain Tax impact related to antique painting.

- Provide accurate referencing to support your answer.

Capital Gain Tax in relation to historical sculpture

- Describe the effect of Capital Gain Tax concerned with the historical sculpture.

- Make sure that you have followed the correct Capital Gains Tax calculation method. Also, check the comments and CGT figures are stated correctly.

Capital Gain Tax in relating to antique jewellery piece

- Identify the capital gain or loss related to antique jewellery along with clear comments.

Capital Gain Tax concerned with picture

Regarding the picture, find the CGT effects and provide an accurate Harvard referencing style to support your answer.

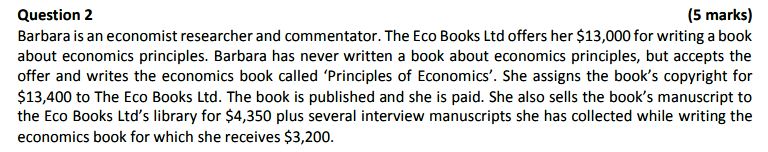

The above question asks you to discuss the payments made to Barbara and observe whether these incomes are from Barbara’s personal exertion or not. Find out whether your answer is different if Barbara wrote the Principles of Economics’ book before signing a contract with The Eco Books Ltd. Moreover, you must provide appropriate case law and statutory to support your answer.

Hints To Solve HI6028 Assessment Question 2

Discuss Barbara ‘s income under the case scenario

Based on the above scenario, our taxation law expert says that $13,000 is not an income as it seems a personal exertion or favour. It can be said because it has been never been said that Barbara is experienced in writing books, therefore it is not chargeable.

Discuss Barbara ‘s income under the alternative scenario

The expenses made for this work will be taxable under the ATO (Australian Taxation Office) Income tax regulatory laws. For instance, the offer amount to $13,000 and copyright concern amount equal to $4350 and $3200 must be collectively tax chargeable.

13,000 * nil = $0

($18000-$13000) = $5,000 * nil = $0

($13,500-$5,000) = $8,400 * 19c = $1,596

($4,350+$3,200) = $7,550 * 19c = $1,434.5

Income tax would be $3030.5

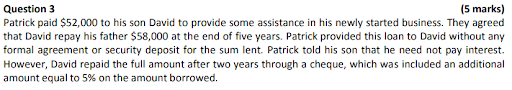

Going through the given case law, discuss the effect of arrangements on the assessable income of Patrick.

If you are finding difficulties in calculating the assessable income of Patrick, take help from taxation law assignment help services. These services are associated with a pool of professional academic writers who have drafted numerous assignments.

Also Read: BACC318 Assessment Sample

How Do You Ensure a Distinction Grade in HI6028 Taxation Law Assessment?

Plagiarism-free document:

Whenever a university assigns HI6028: Taxation Law assignment, they expect to get an original and unique piece of paper. Many students are caught unintentionally in plagiarism but do not worry because online assignment expert is available to enhance the skills to avoid plagiarism. Therefore, get in touch with them whenever you find duplicate content in your assignment.

Knowledge of Taxation Principles:

Every government is meant to be driven in designing and applying an equitable taxation rule with the help of a few basic concepts. It includes adequacy, broad basing, compatibility, earmarking, efficiency, equity, neutrality, and so on. Thus, it becomes important to have in-depth knowledge of such concepts to write HI6028 Taxation Law assignment.

Proper referencing

In HI6028: Taxation Theory, Practice, and Law assessment, you are asked to use the Harvard referencing style. If you want to gain complete knowledge about references, get in touch with Online Assignment Expert.

Order Your HI6028 Assignment Solution with a Free Turnitin Report Today!

Online Assignment Expert is a firm based in Australia and assists students in Australia, the UK, USA, Canada, Singapore, etc. We are associated with experts who have a critique pair of eyes to scrutinise each word of your document and promise to deliver the best academic writing experiences. By online assignment help services, we assure you to meet all the requirements of your project and check the plagiarism through Turnitin used to scan files.

A number of students approach us to acquire a unique, original, and up-to-the-mark solution. The professionals are well-known with the academic guidelines required for multiple referencing styles such as APA, Harvard, MLA, Chicago, etc. Thus, to grab our services, just place your order now. You can send your requirementsHI6028: Taxation Theory, Practice & Law Assignment Sample and Answer to us via email or call us at our 24x7 customer support phone number and let us know your requirements.

Related Blogs

Subscribe Our Newsletter & get Information about latest courses